Conventional

Wholesale Lending Solutions

What Are Fannie Mae & Freddie Mac Loans?

Fannie Mae and Freddie Mac are two government-sponsored enterprises (GSEs) that were created to provide more liquidity and stability to the US mortgage market. These entities purchase mortgages from lenders and then package them into mortgage-backed securities (MBS) that can be sold to investors on the secondary market. Fannie Mae and Freddie Mac loans are essentially mortgages that are backed by one of these two GSEs.

Here are a few key points about Fannie Mae and Freddie Mac loans:

-

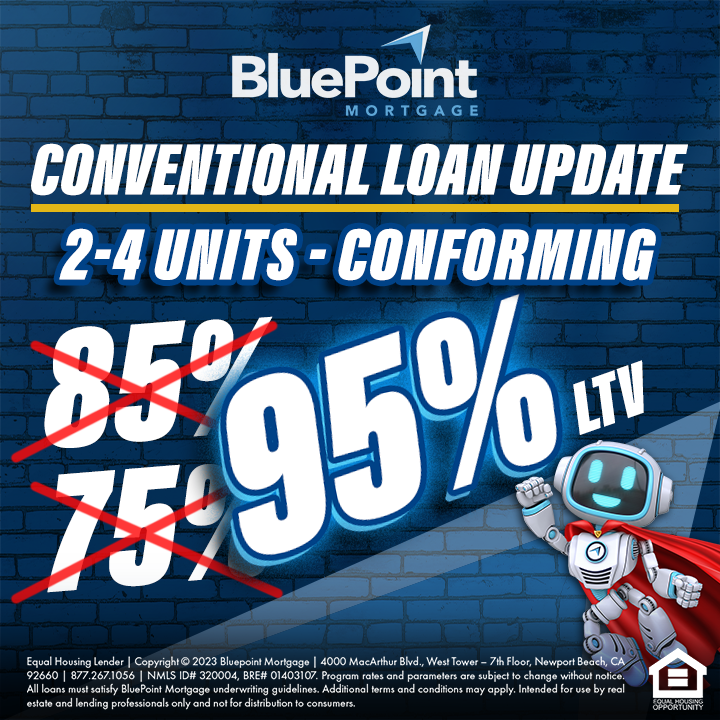

Fannie Mae and Freddie Mac loans are conforming loans, which means they adhere to certain standards and guidelines set forth by the GSEs. These standards include loan limits, credit score requirements, and debt-to-income ratio (DTI) guidelines.

-

Fannie Mae and Freddie Mac loans are often easier to qualify for compared to other types of mortgages because they have more lenient credit requirements and allow for lower down payments.

-

Fannie Mae and Freddie Mac loans can offer lower interest rates compared to other types of mortgages because they are considered to be less risky for lenders. This is because they are backed by the government and because the loans adhere to certain standards and guidelines.

-

Fannie Mae and Freddie Mac loans can be fixed-rate or adjustable-rate mortgages (ARMs). Borrowers can choose a loan term that works best for their financial situation, whether it’s a 15-year, 20-year, or 30-year loan.

-

Fannie Mae and Freddie Mac loans are often sold to investors on the secondary market, which means that borrowers may have a different lender or loan servicer than the original lender who provided the mortgage. However, the terms and conditions of the loan will remain the same throughout the life of the mortgage.